Schedule C is a crucial document for individuals filing their taxes, particularly if they are self-employed or have a small business. This form allows taxpayers to report their profits and losses from business operations. To assist you in understanding Schedule C and its importance, we have compiled a list of helpful resources and sample forms.

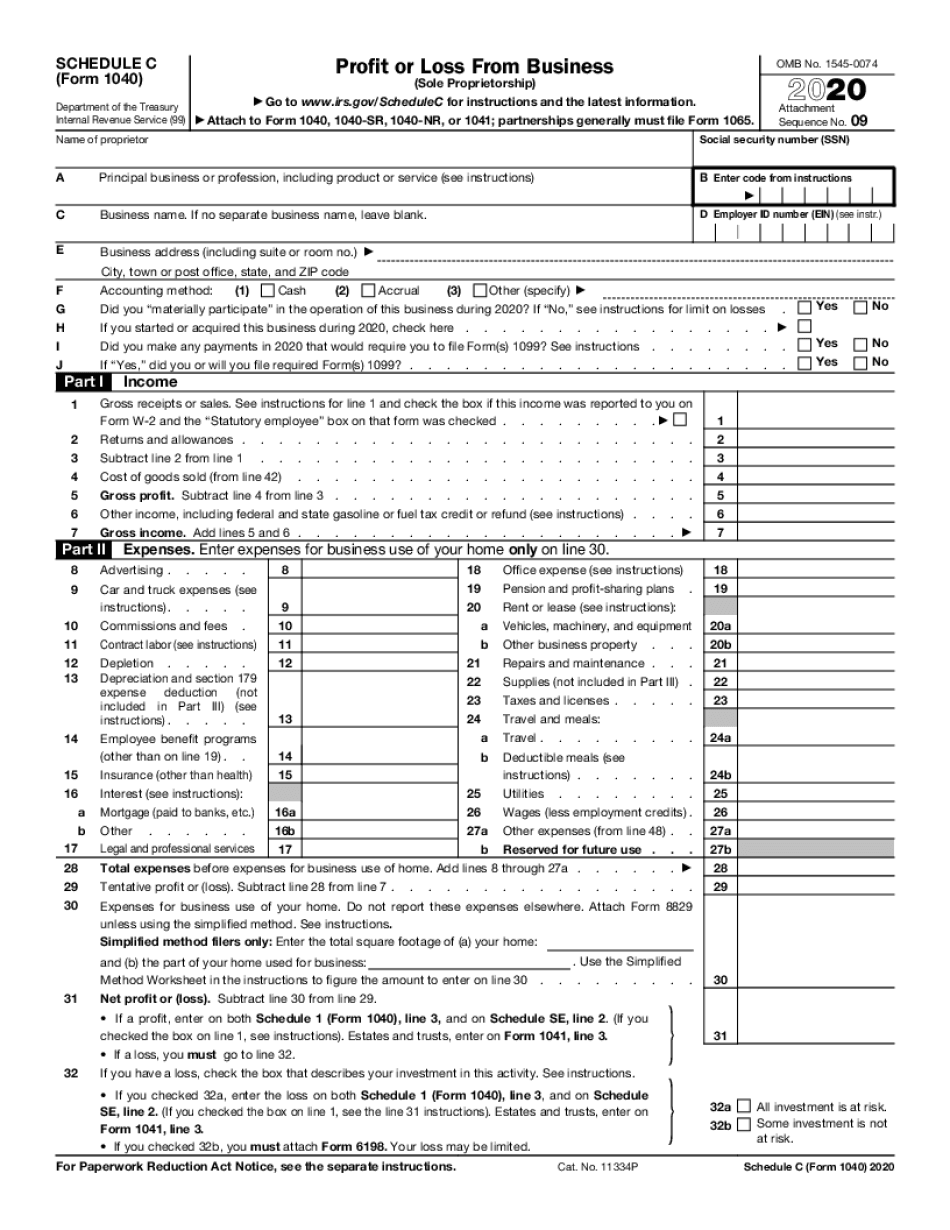

This resource provides a printable and fillable sample of Schedule C in PDF format. It offers a convenient way to visualize and understand the structure and content of the form.

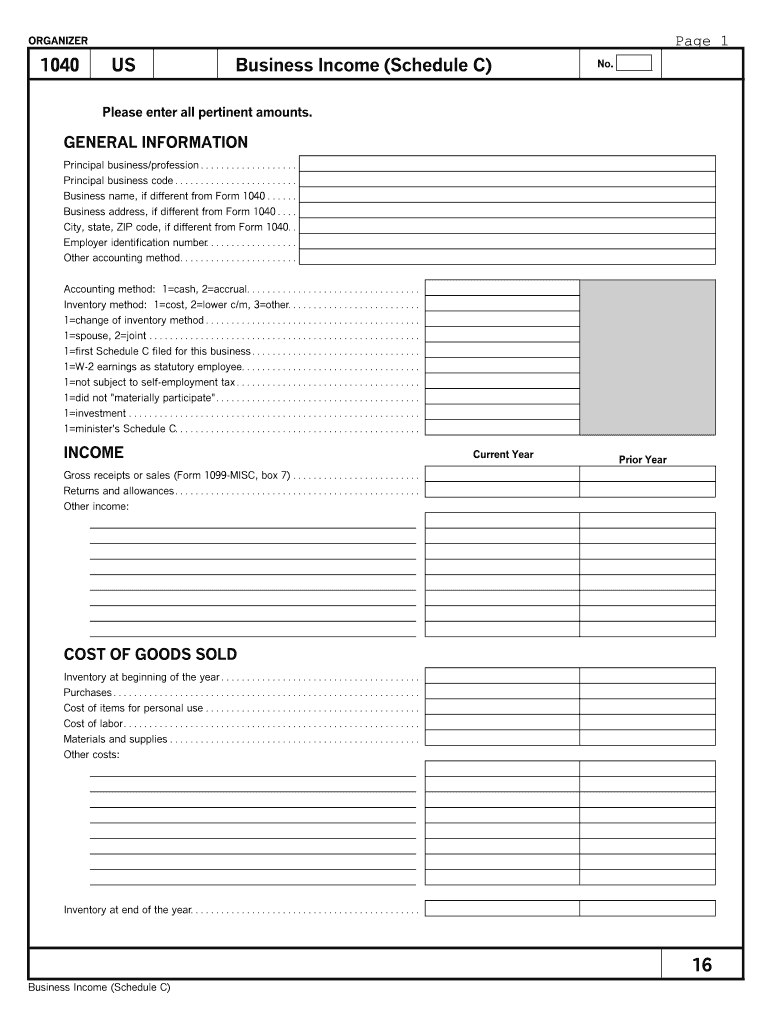

If you prefer working with MS Word documents, this resource offers a collection of nine sample Schedule C forms in both PDF and MS Word formats. These samples can serve as references or templates when filling out your own Schedule C.

If you are looking for a digital solution to complete and sign your Schedule C form, this resource provides a printable PDF template that can be filled out and signed electronically using the signNow platform.

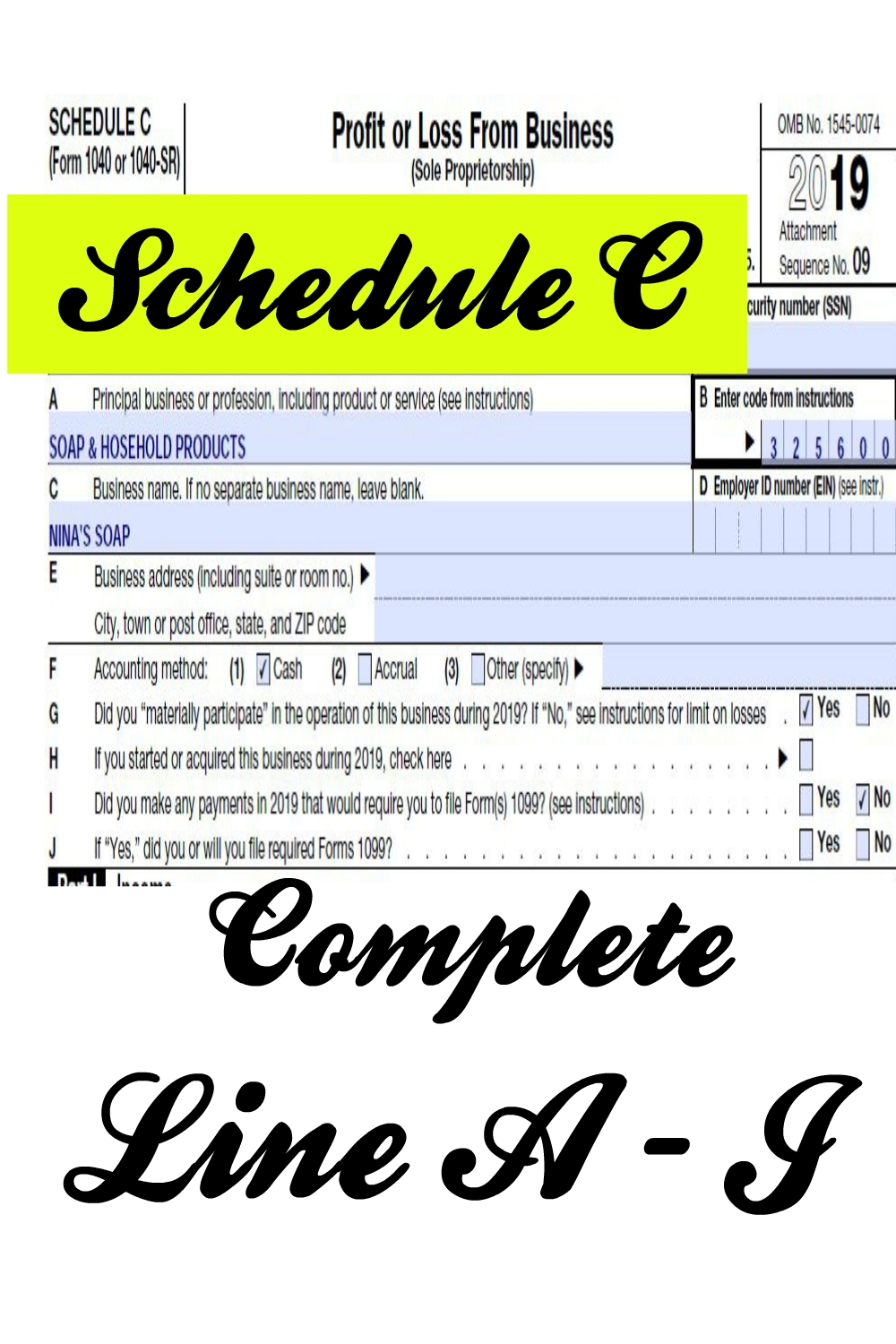

For individuals seeking a comprehensive guide on how to complete Schedule C Form 1040, this resource from The Usual Stuff offers valuable insights and step-by-step instructions. It covers everything from the various sections of the form to best practices for accurate reporting.

Nina’s Soap provides an informative article breaking down the different lines (A to J) of the 2019 Schedule C Form 1040. This resource can assist taxpayers in understanding each line item and ensuring they accurately report their business income, deductions, and other relevant information.

If you are currently in need of sample Schedule C forms for the 2021 tax year, this resource offers eight free samples in PDF format. These forms can help you become familiar with the layout and requirements, making it easier to organize and report your business income and expenses.

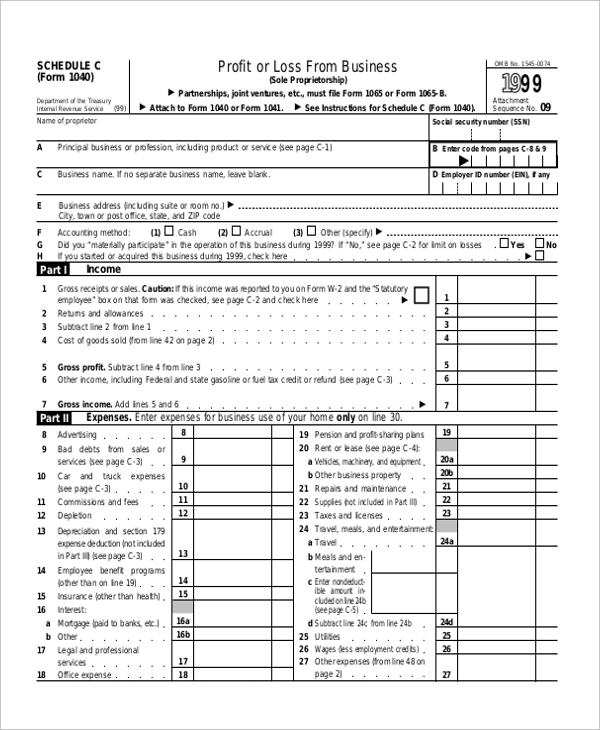

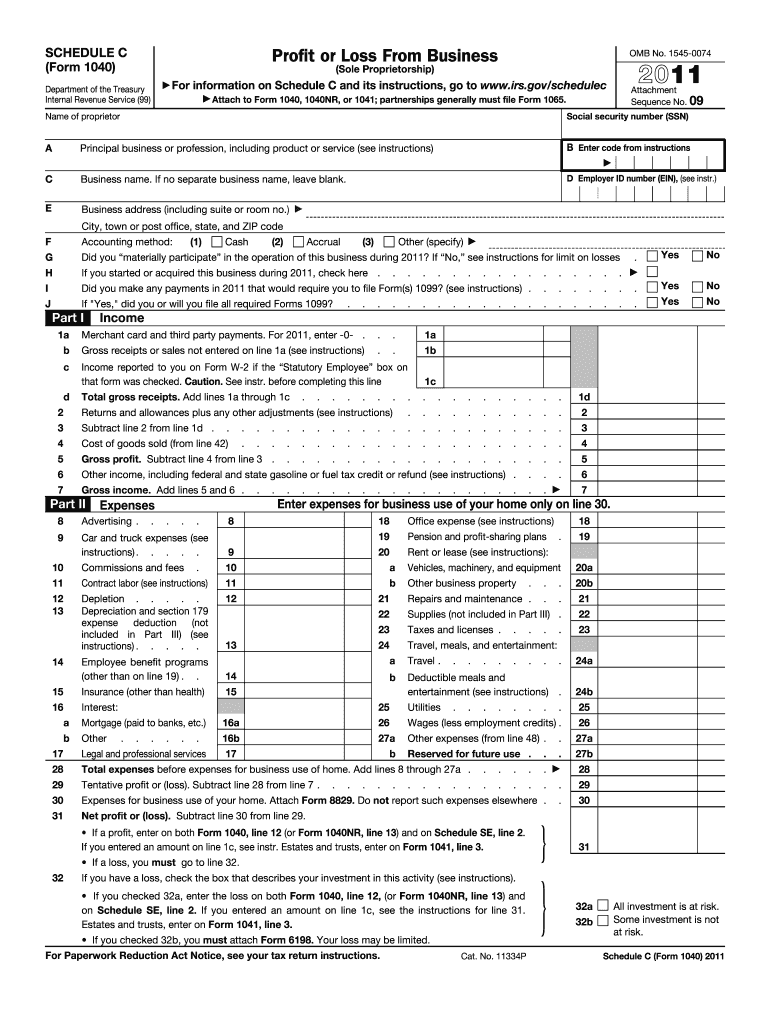

This resource provides access to the printable, fillable, and blank version of the 2011 Form IRS 1040 Schedule C. Although outdated, it can still serve as a useful reference for understanding the structure and information required for the form.

Another valuable resource for those seeking sample Schedule C forms is this collection of nine samples in both PDF and MS Word formats. These samples cover a range of scenarios and can be customized to fit your specific business needs.

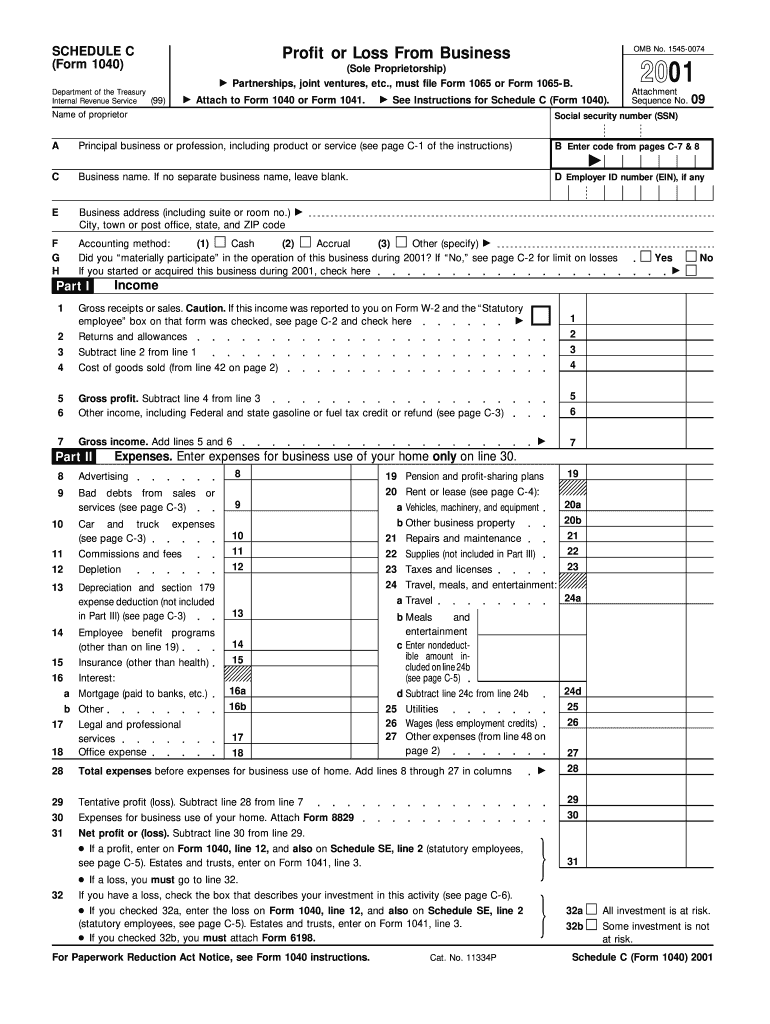

For individuals who require the 2001 version of Form IRS 1040 Schedule C, this resource offers a printable, fillable, and blank template. Although outdated, it can still serve as a reference for historical purposes or to understand the changes that have occurred over time.

If you are looking for a free printable version of Schedule C tax form for the 2022 tax year, this resource provides a comprehensive printable form with instructions and FAQs. It simplifies the process of filling out the form and ensures accurate reporting.

These resources offer a wealth of information and tools to help you understand and complete Schedule C. Whether you prefer printable forms, digital templates, or detailed instructions, these resources cater to various preferences and needs. Ensure that you consult the relevant regulations and guidelines pertaining to your specific tax situation and seek professional advice if necessary. Utilize these resources as a starting point to increase your understanding and effectiveness in completing your Schedule C form accurately and efficiently.