Being a truck driver comes with its fair share of expenses. From fuel costs to maintenance fees, it’s crucial for truck drivers to keep track of their expenses in order to maximize their tax deductions. In this article, we will provide you with valuable information and resources to help you navigate the world of truck driver expenses and tax deductions.

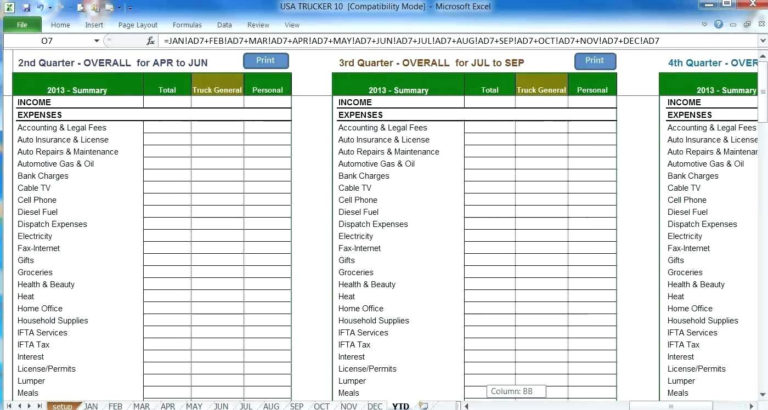

Trucker Expense Spreadsheet

Keeping track of your expenses can be made much easier with the help of a well-organized spreadsheet. The above image showcases a comprehensive trucker expense spreadsheet that can assist you in effectively tracking your expenses. The spreadsheet includes categories such as fuel costs, maintenance fees, tolls, and more. By meticulously recording your expenses using a spreadsheet like this, you can ensure that you don’t miss out on any valuable tax deductions.

Keeping track of your expenses can be made much easier with the help of a well-organized spreadsheet. The above image showcases a comprehensive trucker expense spreadsheet that can assist you in effectively tracking your expenses. The spreadsheet includes categories such as fuel costs, maintenance fees, tolls, and more. By meticulously recording your expenses using a spreadsheet like this, you can ensure that you don’t miss out on any valuable tax deductions.

Owner Operator Expense Spreadsheet

If you are an owner operator, it’s crucial to track your expenses separately from those of your trucking company. The above image showcases a free owner operator expense spreadsheet that can assist you in precisely recording your expenses. By separating your personal expenses from your business expenses, you can ensure accurate financial reporting and maximize your tax deductions.

If you are an owner operator, it’s crucial to track your expenses separately from those of your trucking company. The above image showcases a free owner operator expense spreadsheet that can assist you in precisely recording your expenses. By separating your personal expenses from your business expenses, you can ensure accurate financial reporting and maximize your tax deductions.

Truck Driver Expense Owner Operator Tax Deductions Worksheet

In order to claim tax deductions as a truck driver, it’s important to keep a detailed record of your expenses. The image above showcases a printable truck driver expense owner operator tax deductions worksheet. By filling out this worksheet, you can systematically list your expenses and ensure that you don’t miss out on any potential tax deductions.

In order to claim tax deductions as a truck driver, it’s important to keep a detailed record of your expenses. The image above showcases a printable truck driver expense owner operator tax deductions worksheet. By filling out this worksheet, you can systematically list your expenses and ensure that you don’t miss out on any potential tax deductions.

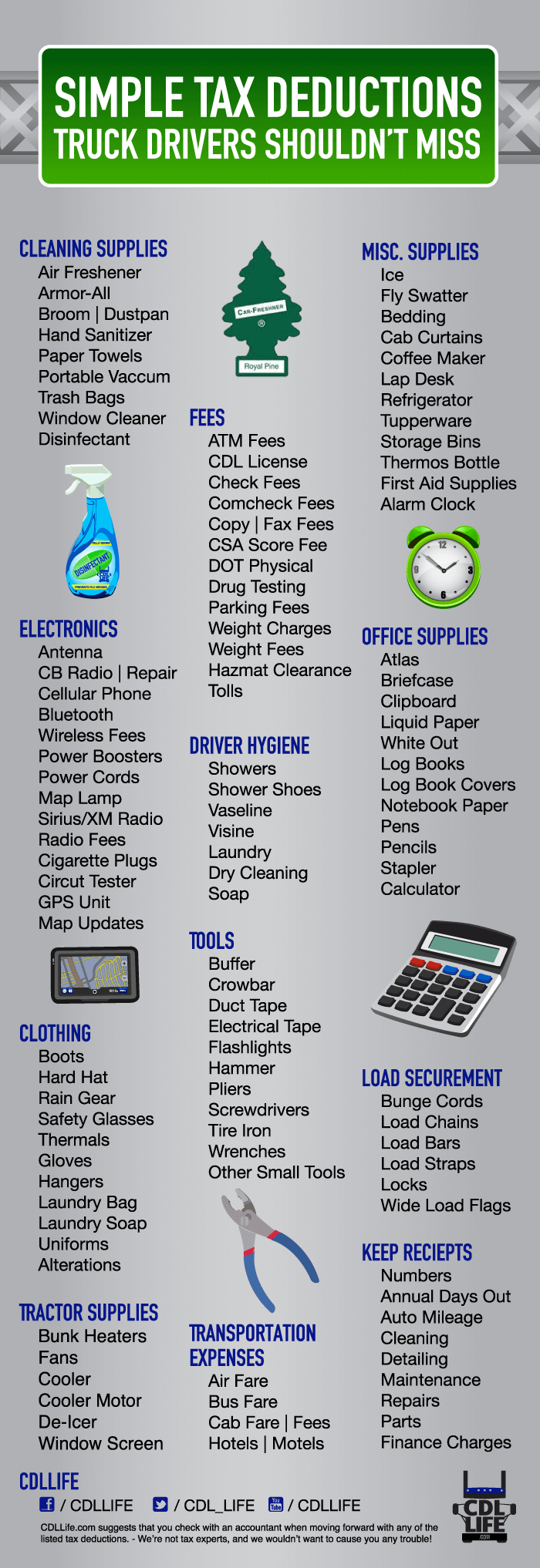

Overlooked Tax Deductions for Truck Drivers

As a truck driver, it’s important to be aware of the tax deductions that you may be eligible for. The image above highlights some often overlooked tax deductions for truck drivers. These deductions include expenses such as meals on the road, lodging, uniforms, and even mobile phone expenses. By taking advantage of these deductions, you can reduce your taxable income and potentially save a significant amount of money.

As a truck driver, it’s important to be aware of the tax deductions that you may be eligible for. The image above highlights some often overlooked tax deductions for truck drivers. These deductions include expenses such as meals on the road, lodging, uniforms, and even mobile phone expenses. By taking advantage of these deductions, you can reduce your taxable income and potentially save a significant amount of money.

Being informed about truck driver expenses and tax deductions is essential for any truck driver looking to maximize their financial benefits. By utilizing spreadsheets, worksheets, and staying up-to-date with overlooked tax deductions, truck drivers can ensure accurate financial reporting and potentially save a significant amount of money in taxes.

Remember to consult with a tax professional to ensure that you are properly claiming your tax deductions and receiving all the benefits you are entitled to as a truck driver. They can provide personalized advice and guidance based on your specific situation.

Keep track of your expenses, stay informed about tax deductions, and make the most of your truck driver journey!