I recently stumbled upon some useful information regarding IRS Form W-8 and wanted to share it with you. Whether you’re an individual or a limited company, understanding and completing this form correctly is essential. So, let’s dive into the details and simplify the process for you.

IRS Form W-8 Printable

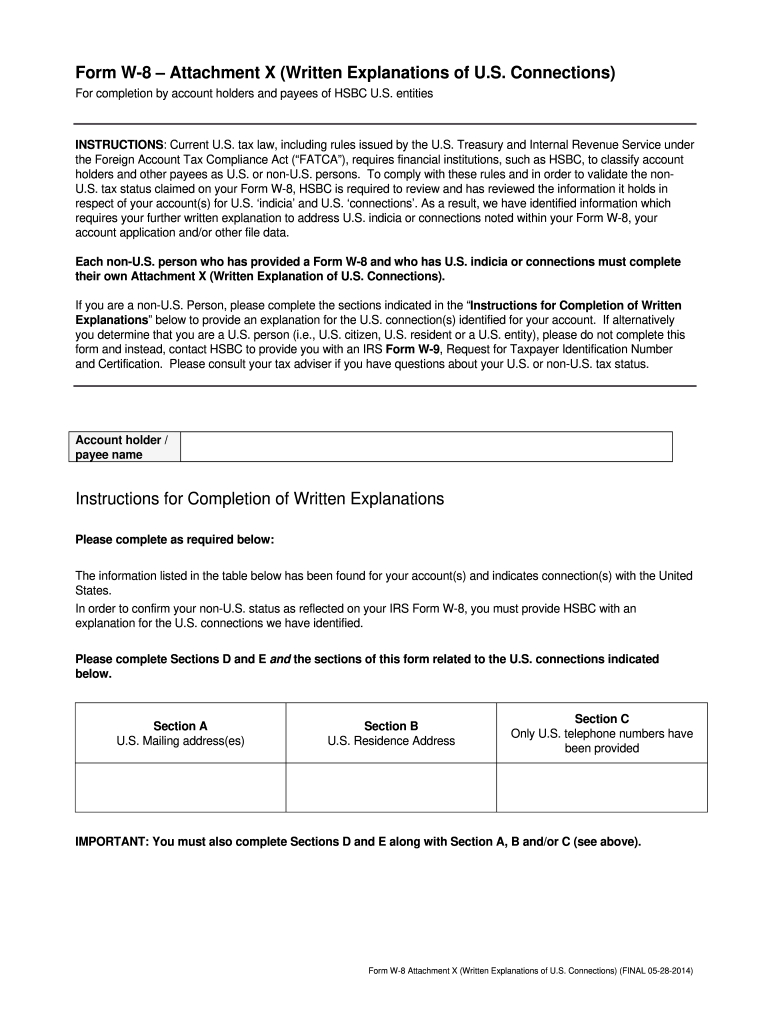

IRS Form W-8 is an important document that enables foreign individuals or entities to claim exemptions from or lower their tax withholding in the United States. It is crucial for non-U.S. residents who earn income from U.S. sources, such as dividends, rental income, or royalties, to fill out this form accurately.

To ensure you provide all the necessary information, it’s helpful to have a printable version of Form W-8. You can easily find a printable PDF template of IRS Form W-8 on Example Calendar Printable’s website. This template allows you to fill out and sign the form digitally, making the process even more convenient. Just visit the provided link for access.

To ensure you provide all the necessary information, it’s helpful to have a printable version of Form W-8. You can easily find a printable PDF template of IRS Form W-8 on Example Calendar Printable’s website. This template allows you to fill out and sign the form digitally, making the process even more convenient. Just visit the provided link for access.

W-8 Form for Limited Company

If you are representing a limited company and need to fill out Form W-8, Armando Friend’s Template can provide you with the necessary guidance. Finding the right template specifically designed for limited companies can save you time and ensure accurate completion of the form. Visit the mentioned link to preview and download the template.

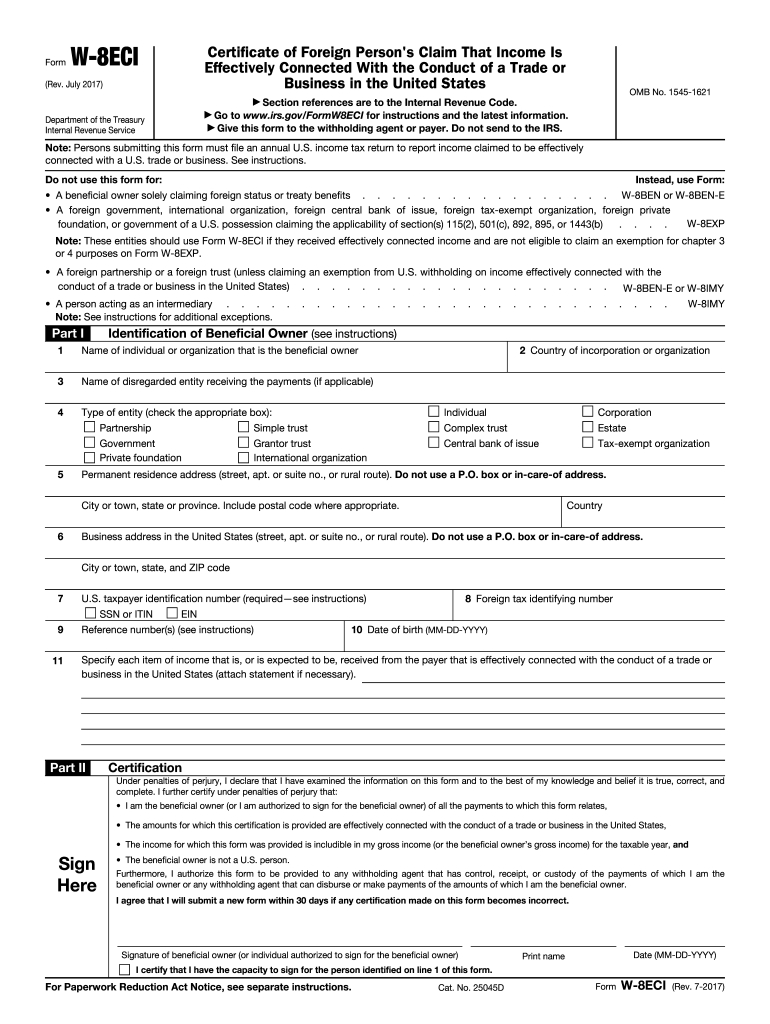

Form W-8ECI Printable

Form W-8ECI Printable

Form W-8ECI is a variant of Form W-8 designed for foreign entities claiming that the income they receive is effectively connected to a trade or business within the United States. If you fall into this category, having a printable PDF template of Form W-8ECI can simplify the process. Example Calendar Printable provides a fillable and signable version of this form. Check out the link provided to access the template.

Completing Form W-8

Completing Form W-8

When completing Form W-8, it’s essential to provide accurate and up-to-date information. The form and its instructions provide thorough guidance on each section. Additionally, several YouTube tutorials offer step-by-step instructions to assist you in correctly filling out the form. One such tutorial can be found at the following link:

This video tutorial walks you through the process of completing Form W-8BEN, which is a variation of IRS Form W-8 designed for individuals. Although the specific form may vary, the overall process and sections to be completed remain similar for all W-8 forms.

This video tutorial walks you through the process of completing Form W-8BEN, which is a variation of IRS Form W-8 designed for individuals. Although the specific form may vary, the overall process and sections to be completed remain similar for all W-8 forms.

Understanding W-8 Forms

To gain a comprehensive understanding of W-8 forms and their various types, it’s helpful to consult reliable sources. Investopedia offers a clear and concise definition of W-8 forms. You can refer to the link below to familiarize yourself with these important documents:

:max_bytes(150000):strip_icc()/W-8EXP-1-2ca6feb477d840d381382d8a8dcb5f12.png) By understanding the purpose and intricacies of W-8 forms, you can ensure compliance with U.S. tax regulations and make the process smoother for yourself or your business.

By understanding the purpose and intricacies of W-8 forms, you can ensure compliance with U.S. tax regulations and make the process smoother for yourself or your business.

In conclusion, IRS Form W-8 is a crucial document for non-U.S. residents and foreign entities earning income from U.S. sources. By utilizing printable and fillable templates, as well as following step-by-step instructions and tutorials, you can accurately complete these forms. Remember to consult reliable sources, such as Example Calendar Printable, Armando Friend’s Template, and Investopedia, for further assistance and guidance. Stay organized, and make sure to provide accurate information to ensure a hassle-free experience with IRS Form W-8!