When it comes to tax season, one important document that individuals need to be familiar with is the W-9 form. The W-9 form, also known as the Request for Taxpayer Identification Number and Certification, is used by businesses to gather information from individuals who they will be paying as independent contractors or freelancers.

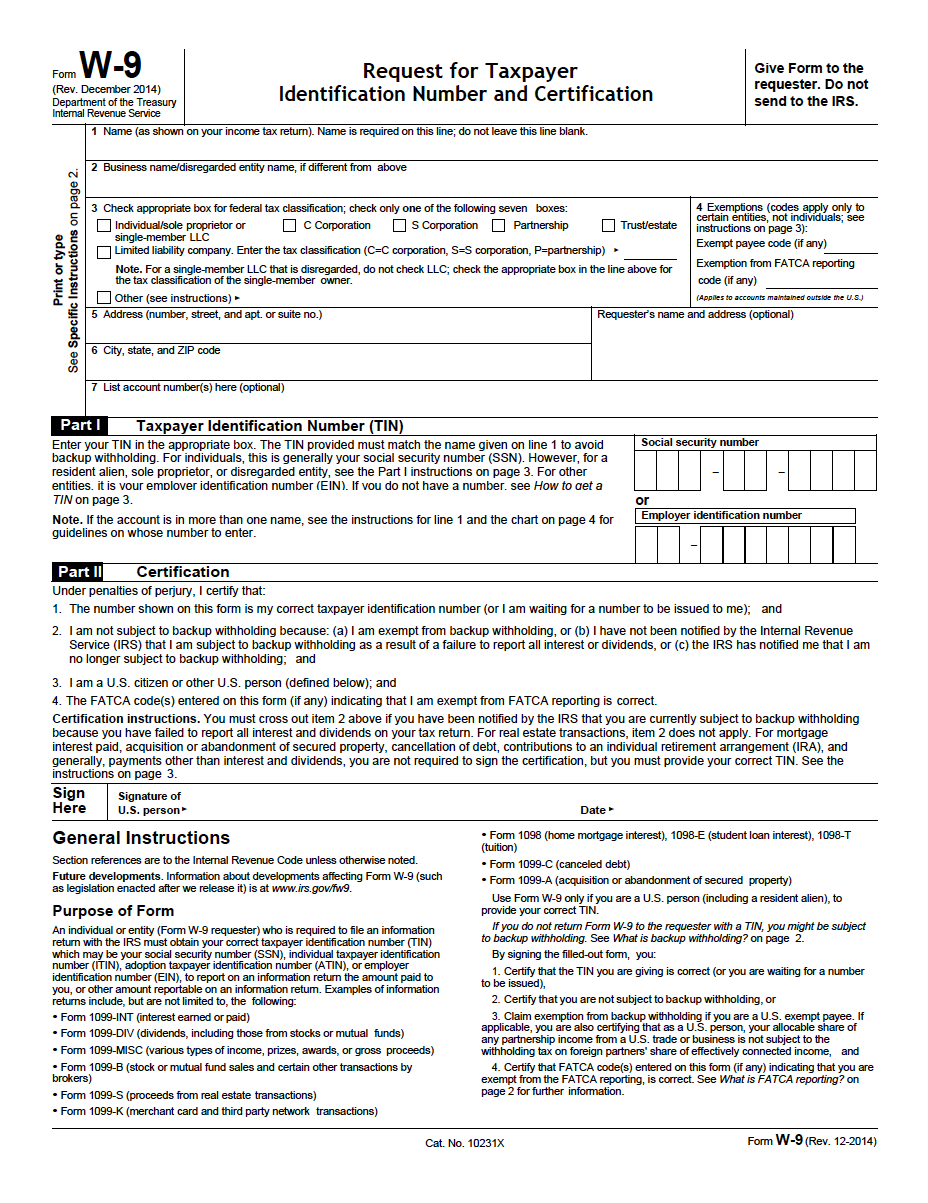

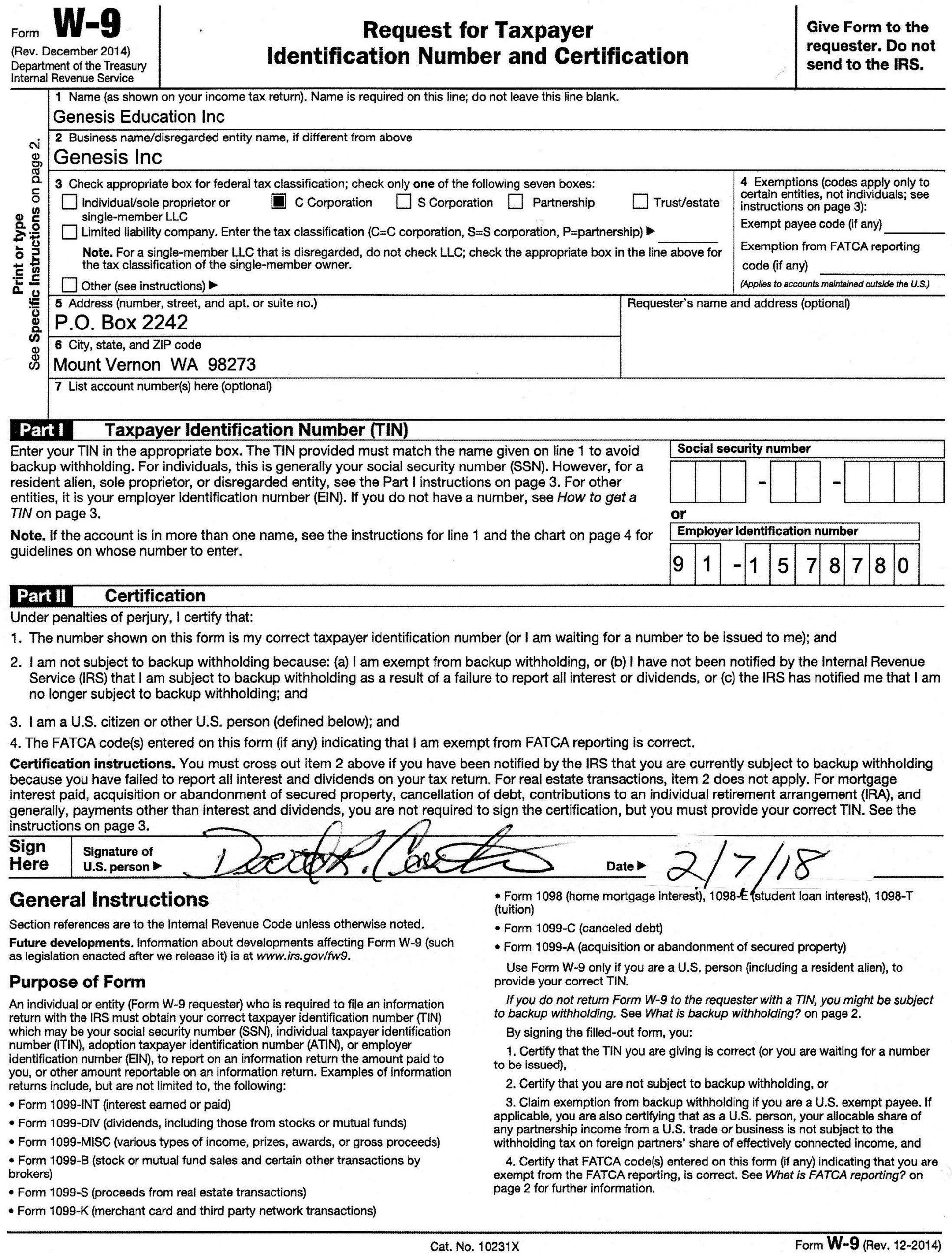

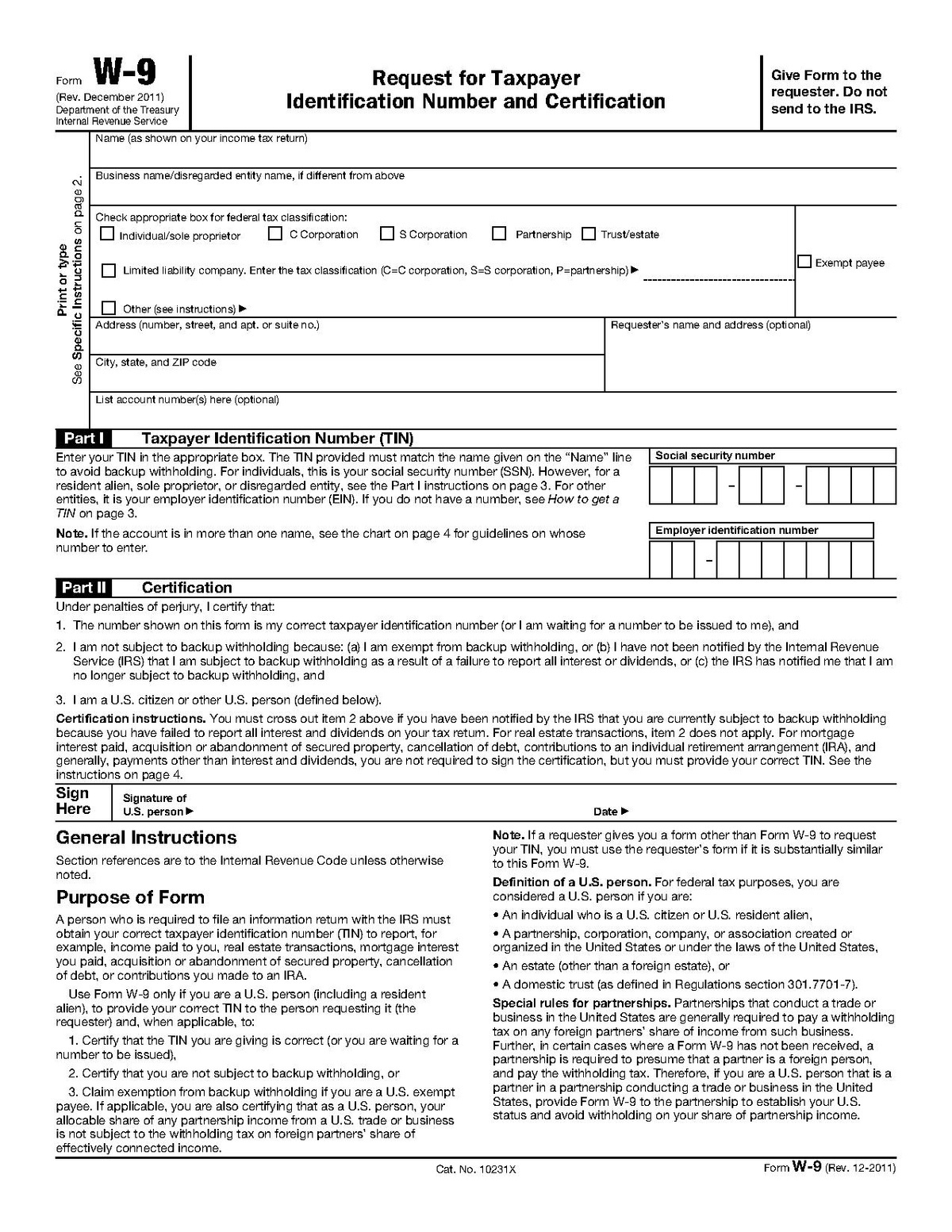

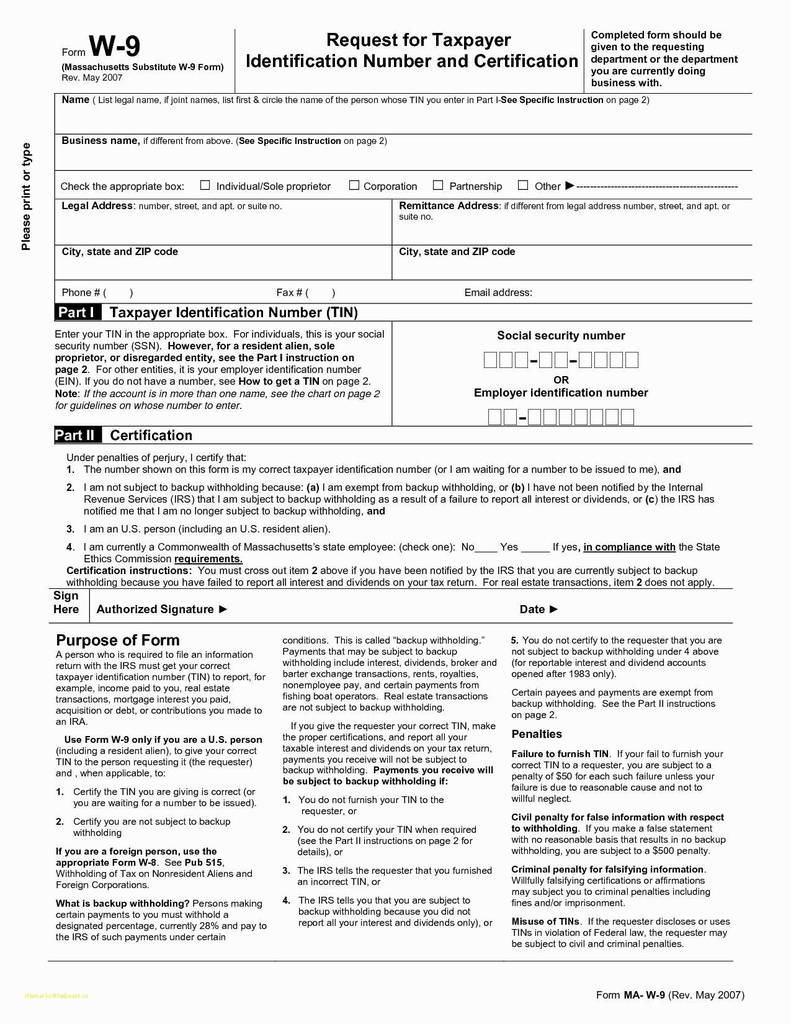

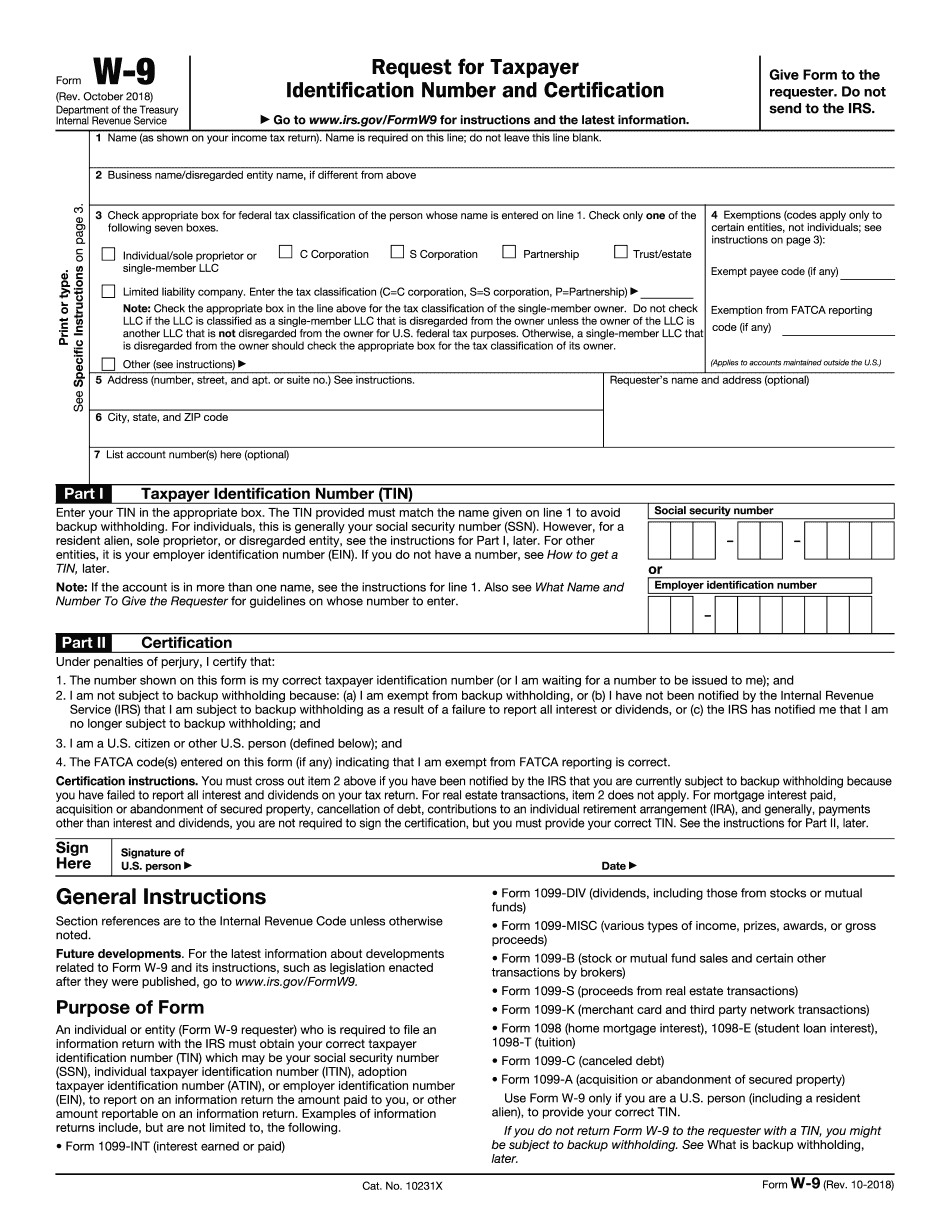

W-9 Form - Request For Taxpayer Identification Number And Certification

The W-9 form is an important document required by the Internal Revenue Service (IRS) for tax purposes. It is used to obtain the taxpayer identification number of the individual or business receiving income. This form is necessary for businesses to report various types of payments, including payments for freelance work, professional services, rent, or other income to the IRS. It helps to ensure that the individual or business receiving the payment is correctly identified and that the appropriate taxes are withheld or reported.

The W-9 form is an important document required by the Internal Revenue Service (IRS) for tax purposes. It is used to obtain the taxpayer identification number of the individual or business receiving income. This form is necessary for businesses to report various types of payments, including payments for freelance work, professional services, rent, or other income to the IRS. It helps to ensure that the individual or business receiving the payment is correctly identified and that the appropriate taxes are withheld or reported.

How to Fill Out a W-9 Form

Filling out a W-9 form is relatively straightforward. First, you need to provide your name and business name, if applicable, and address. You also need to indicate your taxpayer identification number, which can be your Social Security Number (SSN) or Employer Identification Number (EIN). Additionally, you will need to certify that the information provided is correct and that you are not subject to backup withholding.

Filling out a W-9 form is relatively straightforward. First, you need to provide your name and business name, if applicable, and address. You also need to indicate your taxpayer identification number, which can be your Social Security Number (SSN) or Employer Identification Number (EIN). Additionally, you will need to certify that the information provided is correct and that you are not subject to backup withholding.

Submitting Your W-9 Form

Once you have completed your W-9 form, you will need to submit it to the business or individual requesting the information. Most commonly, this is done by providing a physical copy of the completed form. However, some businesses may allow you to submit the form electronically through their online portal or via email. It’s essential to follow the instructions provided by the requesting party to ensure proper submission.

Once you have completed your W-9 form, you will need to submit it to the business or individual requesting the information. Most commonly, this is done by providing a physical copy of the completed form. However, some businesses may allow you to submit the form electronically through their online portal or via email. It’s essential to follow the instructions provided by the requesting party to ensure proper submission.

Why Is the W-9 Form Important?

The W-9 form is crucial for businesses to accurately report payments made to individuals or businesses and to comply with IRS regulations. It helps the IRS ensure that income is properly reported and taxed. By providing accurate information on the W-9 form, you are helping to prevent potential tax issues and ensuring that you receive any necessary tax documentation, such as a 1099 form, at the end of the year.

The W-9 form is crucial for businesses to accurately report payments made to individuals or businesses and to comply with IRS regulations. It helps the IRS ensure that income is properly reported and taxed. By providing accurate information on the W-9 form, you are helping to prevent potential tax issues and ensuring that you receive any necessary tax documentation, such as a 1099 form, at the end of the year.

Printable W-9 Form

If you need to fill out a W-9 form, there are various resources available online to assist you. Many websites offer printable versions of the form that you can easily download and complete. Make sure to double-check the website’s credibility and ensure that you are using the most recent version of the W-9 form.

If you need to fill out a W-9 form, there are various resources available online to assist you. Many websites offer printable versions of the form that you can easily download and complete. Make sure to double-check the website’s credibility and ensure that you are using the most recent version of the W-9 form.

Conclusion

The W-9 form is a necessary document for businesses to collect taxpayer identification information from individuals or businesses they pay. By providing accurate information on the W-9 form, you are ensuring proper tax reporting and compliance with IRS regulations. It is essential to keep a record of the W-9 forms you submit and any earnings you receive as an independent contractor or freelancer. If you have any questions about filling out or submitting the W-9 form, it is recommended to consult with a tax professional.

The W-9 form is a necessary document for businesses to collect taxpayer identification information from individuals or businesses they pay. By providing accurate information on the W-9 form, you are ensuring proper tax reporting and compliance with IRS regulations. It is essential to keep a record of the W-9 forms you submit and any earnings you receive as an independent contractor or freelancer. If you have any questions about filling out or submitting the W-9 form, it is recommended to consult with a tax professional.

Remember, when it comes to tax-related documents, accuracy is key. Take the time to fill out the W-9 form correctly, review it for any errors or omissions, and submit it promptly to the business or individual requesting the information. By doing so, you will contribute to a smooth tax process and avoid potential issues in the future.